Press Releases

Galaxy Entertainment Group Reports Selected Unaudited 2012 First Quarter

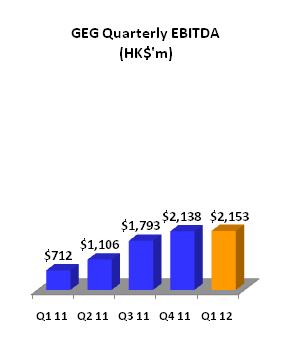

Financial Data Record Group EBITDA, Tripled Year-on-Year to $2.2 billion

14th Consecutive Quarter of EBITDA Growth

Galaxy Macau™ Generated $1.3 billion of EBITDA, up 6%

Hong Kong, May 10th, 2012 – Galaxy Entertainment Group Limited (“GEG” or “the Group”) (HKEx stock code: 27) today reported selected unaudited 2012 first quarter financial data, for the three months ending 31 March 2012.

First Quarter 2012 HIGHLIGHTS

GEG

- All-time record EBITDA of $2.2 billion, up 202% year-on-year

- 14th consecutive quarter of Group EBITDA growth

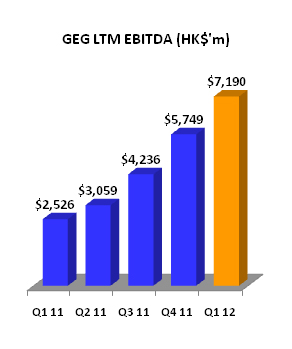

- Latest twelve months Group EBITDA to March 31, 2012 increased by 185% to $7.2 billion

- Reported strong Mass revenues at Galaxy Macau™ and StarWorld which increased quarter-on-quarter by 16% and 13%, respectively

Galaxy Macau™

- EBITDA of $1.3 billion grew 6% in Q1 2012 for the third full quarter of operation

- EBITDA margin improved by 12% quarter-on-quarter from 16% to 18%

- Strong hotel occupancy of 89% for Q1 2012

- Enhanced gaming and entertainment offering with the opening of two Sky casinos, The Pavilion High Limit Slots, an additional VIP Room and China Rouge

- Q1 2012 annualised ROI of 32%

StarWorld

- 15th consecutive quarter of EBITDA growth at $852 million, up 28% year-on-year

- ROI improved to 91%

- Strong hotel occupancy of 98% for Q1 2012

Balance Sheet

- Strong cash on hand of $9.5 billion at 31 March 2012, including restricted cash of $1.9 billion

Subsequent Event: Announcement of Galaxy Macau™ Phase 2

- Announced the proposed $16 billion Galaxy Macau™ Phase 2 on April 26, 2012

- Target completion is in mid 2015

- GEG does not intend to issue equity

Dr. Lui Che-woo, Chairman of GEG said:

“This is another set of strong results, our 14th consecutive quarter of EBITDA growth. Both our flagship properties delivered gains in profitability. As Galaxy Macau™ approaches its one year anniversary; it continues to exceed our expectations, as well as those of our guests.”

“Today’s performance announcement also underscores the exciting potential of our recently announced Phase 2 development of Galaxy Macau™. We are constantly striving to achieve even greater success in the pursuit of our goal, to become Asia’s Leading Gaming and Entertainment Corporation.”

Group Financial Results

The Group performed well in the first quarter of 2012, delivering its 14th consecutive quarter of EBITDA growth with a record of $2.2 billion. As of 31 March 2012, LTM (latest twelve months) Group EBITDA was $7.2 billion. Group revenue reached $13.2 billion in the quarter, an increase of 130% year-on-year.

City Clubs and the Construction Materials Division performed solidly.

Galaxy Macau™

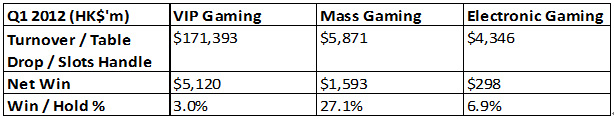

Galaxy Macau™, GEG’s integrated resort in Cotai, generated revenue of $7.2 billion and EBITDA of $1.3 billion in Q1 2012 in its third full quarter of operation. Mass Market revenue increased by 16% quarter-on-quarter. Operational efficiencies combined with strong performance in Mass Market resulted in EBITDA margin improving for the period to 18% calculated under HK GAAP, and 26% under US GAAP. On an annualised basis, ROI stood at 32%.

The property’s success is based on its wide range of world class Asian themed entertainment, accommodation and dining options. During the quarter, its ‘World Class, Asian Heart’ product and service offering was further enhanced with the opening of two new luxurious Sky casinos, The Pavilion High Limit Slots, the spectacular China Rouge private members club and the opening of an additional VIP Room. Galaxy Macau™’s strong hotel occupancy for the quarter was 89%.

StarWorld Hotel & Casino

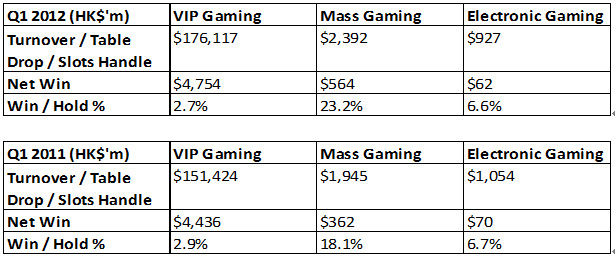

StarWorld, the Group’s flagship property on the Macau peninsula, reported its 15th consecutive quarter of EBITDA growth, up 28% year-on-year to a record of $852 million in Q1 2012.

StarWorld’s EBITDA margin for the quarter was 15% under HK GAAP, compared to 13% in Q1 2011 and 14% in Q4 2011. Under US GAAP, EBITDA margin for the quarter was 26%, compared to 23% in Q1 2011 and 23% in Q4 2011.

Quarterly revenue increased by 11% year-on-year to $5.5 billion, but fell 10% quarter-on-quarter due to a below expected VIP win rate of 2.7% in Q1 2012 (expected win rate: 2.8%) versus Q4 2011 of 3.1% despite healthy VIP volume.

Mass gaming revenue grew 56% year-on-year to $564 million on record volume of $2.4 billion. StarWorld’s strong hotel occupancy for the quarter was 98%.

On an LTM basis, StarWorld generated EBITDA of $3.1 billion which translated to an ROI of 91%.

City Clubs and Construction Materials

City Clubs reported EBITDA of $43 million in Q1 2012 versus $57 million in Q1 2011. Year-on-year EBITDA at the Construction Materials Division grew 22% to $83 million.

Liquidity

As of 31 March 2012, the Group was well capitalised and liquid with $9.5 billion of cash, including restricted cash of $1.9 billion.

Subsequent Event: Announcement of Galaxy Macau™ Phase 2

The recently announced accelerated launch of Phase 2 of Galaxy Macau™ will virtually double the size of the resort to 1.0 million square meters and comprise:

- Two new luxury hotels, the first ever all suite The Ritz-Carlton and the world’s largest JW Marriott, bringing the total offer to five luxury hotels with a grand total of approximately 3,600 rooms

- Greatly expanded retail space to over 100,000 square metres and up to 200 high-end retail outlets

- Over 45 new international food & beverage outlets, taking the total to over 100

- Expanded Meeting, Event and Banquet space for seating capacity of over 3,000 guests

Galaxy Macau™ Phase 2’s target completion is in mid 2015.

- KWIH furthers green practices to support sustainable development by joining “Earth Partner” Programme 2012-2013 23 May 2012

-

Galaxy Entertainment Group Reports Selected Unaudited 2012 First Quarter

Financial Data Record Group EBITDA, Tripled Year-on-Year to $2.2 billion

14th Consecutive Quarter of EBITDA Growth

Galaxy Macau™ Generated $1.3 billion of EBITDA, up 6% 10 May 2012

.jpg)